indiana estate tax return

Assessor Jay County Assessor Jay County Courthouse 1st Floor 120 North Court St Portland IN 47371 Phone 260 726-4456 Fax 260 726-6964. A federal estate tax is paid on the value of the taxable estate that exceeds that threshold amount.

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

Make changes to your 2021 tax return online for up to 3 years after it has been filed and accepted by the IRS through 10312024.

. For example in 2016 a full year Illinois resident works the entire year in Munster Indiana Lake County. You are eligible for the initial 125 Automatic Taxpayer Refund if you filed an Indiana resident tax return for the 2020 tax year with a postmark date of Jan. The Internal Revenue Service IRS requires estates to exceed 114 million to file a federal estate tax return and pay estate tax.

Because the tax being assessed is only on the portion of the estate that exceeds the exclusion limit the effective US. Real estate owners in the state of Indiana must pay taxes on their property every year. For example Indiana requires a waiver if the deceased person was a resident of the state unless the estate is being transferred to a.

Estates valued under that threshold do not pay estate tax and no IRS filing is required. Income Tax Return for Estates and Trusts. Also to note that the Schedule K-1 should be properly filled if the trust has transferred an asset to a beneficiary and claimed a deduction for that.

Indiana Full-Year Resident Individual Income Tax Return. Estate tax rate is substantially lower than the top federal rate of 40 in many instances. Indiana Ohio and North Carolina had estate taxes but they were repealed in.

Every taxpayer has a lifetime estate tax exemption. The capital gains tax can apply to any asset that increases in value. 3 2022 or earlier.

Delivery and Installation Charges Subject to Indiana Sales and Use Tax. Elimination of Form ST-136A Indiana Out-of-State Purchasers Sales Tax Exemption Affidavit. The capital gains tax is what you pay on an assets appreciation during the time that you owned it.

For TurboTax Live Full Service your tax expert will amend your 2021 tax return for you through 11302022. A handful of states collect estate taxes. 8939 historical form only Department of the.

The Indiana inheritance tax was repealed as of December 31 2012. Indiana collects taxes on cigarettes equal to 1 per pack of 20 cigarettes. Replaced by Sales Tax Information Bulletin 92.

5495 For Form 709 gift tax discharge requests or when an estate tax return Form 706 has been filed Department of the Treasury Internal Revenue Service Stop 824G 7940 Kentucky Drive Florence KY 41042-2915. In 2022 the estate tax exemption is 1206 million dollars. At one point all states had an estate tax.

The federal estate tax return offered a credit toward state-level estate taxes and states based their own tax rates on this federal credit. But that changed in 2001 when federal tax law amendments eliminated the credit. The amount of the tax depends on your income your tax filing status and the length of time that you owned the asset.

It later turned around and repealed the tax again retroactively to January 1 2013. Boats and real estate sales may also vary by jurisdiction. Search for Jay County real property and personal property tax records and parcel maps by owner name address tax map number parcel number or legal description.

How Property Taxes Work in Indiana. An Indiana resident tax return means you filed your state taxes using one of the following. Department of the Treasury Internal Revenue Service Center Kansas City MO 64999.

The federal estate tax return has to be filed in the IRS Form 1041 the US. You can learn more about how to collect and file your Indiana sales tax return at the 2022 Indiana Sales Tax Handbook. New Jersey phased out its estate tax in 2018.

As in most other states the Indiana property tax is ad valorem meaning its based on the value of property. Taxes can be divided into two annual installments with one being due on May 10 and the other on November 10. The employer is required to withhold Indiana state income tax from the employees wages at the enacted Indiana state income tax rate of 330 plus the applicable Indiana county income tax rate Lake County 050 for wages earned.

Indiana Inheritance Tax. Indianas sales tax rates for commonly. In Iowa an inheritance tax return will have to be filed which will create a gross estate of the decedent which lists all of the real and personal property in the decedents estate such as real property houses that are located in Iowa automobiles personal property certain types of retirement accounts employee profit sharing or pension.

Terms and conditions may vary and are subject to change without notice. The 2021 rates and brackets were announced by the IRS here What is the form for filing estate tax return. The Ohio estate tax was repealed as of January 1 2013 under Ohio budget laws.

Tennessee repealed its estate tax in. North Carolina also repealed its estate tax on January 1 2010 but it reinstated it a year later. Delivery and Installation Charges Subject to Indiana Sales and Use Tax.

For individuals who die after that date no inheritance tax is due on payments from their estate. The Indiana sales tax rate is 7 as of 2022 and no local sales tax is collected in addition to the IN state tax.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Filing Taxes For Deceased With No Estate H R Block

Betty White S Massive Estate Tax Bill And How Life Insurance Fixes It

Eli Manning Lists Giant New Jersey Estate For 5 25m

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

States With No Estate Tax Or Inheritance Tax Plan Where You Die

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

If You Are An Inhabitant Of Indiana Here Are Provided Some Basics With Respect To Filing Income Tax Https Uslawyer Us Filing Incom Income Tax Income Tax

States With No Estate Tax Or Inheritance Tax Plan Where You Die

How Do State Estate And Inheritance Taxes Work Tax Policy Center

2021 Estate Income Tax Calculator Rates

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

Is There A Federal Inheritance Tax Legalzoom

Is Your Inheritance Considered Taxable Income H R Block

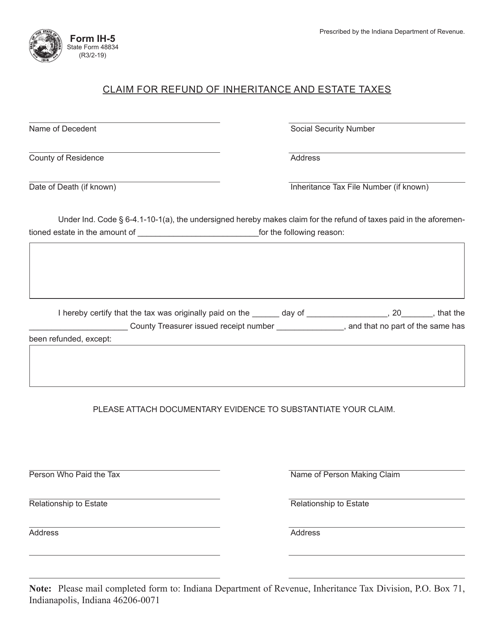

Form Ih 5 State Form 48834 Download Fillable Pdf Or Fill Online Claim For Refund Of Inheritance And Estate Taxes Indiana Templateroller

How Is Tax Liability Calculated Common Tax Questions Answered

How To Avoid Estate Taxes With A Trust

Free Free Hawaii Real Estate Purchase Agreement Template Pdf Property Sale Agreement Templat Contract Template Purchase Agreement Indiana Real Estate